If you want to form a business, you can choose from a wide assortment of businesses, each of which comes with its own set of legal rules and structure. Primarily, 4 types of businesses are available, which include limited liability companies, sole proprietorships, corporations, and partnerships.

Before the creation of the business, it is important that the entrepreneur understand the kind of structure that will be ideal for the success of their venture. In this article, you can get an overview of the different types of businesses, which will be useful to the entrepreneur when making a crucial business decision:

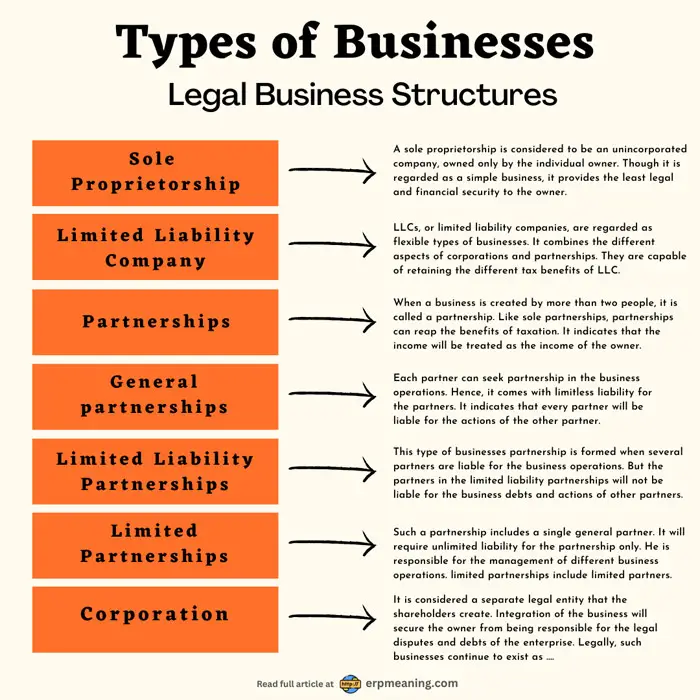

Different types of business

1. Sole Proprietorship

A sole proprietorship is considered to be an unincorporated company, owned only by the individual owner. Though it is regarded as a simple business, it provides the least legal and financial security to the owner. For sole proprietorships, they need to create a different legal identity for the business.

The business owner shares a similar identity with the specific company. Thus, the owner is going to be completely responsible for the different liabilities the business incurs. The business will opt for the option if they are willing to retain complete control of the enterprise.

Besides this, it is regarded as a budget-friendly and hassle-free process to establish a specific sole proprietorship. Besides this, it provides different kinds of tax benefits. Income is the personal income of the owner. There are only a few regulations needed for sole proprietorships.

2. Limited Liability Company

LLCs, or limited liability companies, are regarded as flexible types of businesses. It combines the different aspects of corporations and partnerships. They are capable of retaining the different tax benefits of limited liability corporations and sole proprietorships.

The Limited Liability Company is allowed to select between various kinds of tax treatments. If the LLC is not allowed to be treated as a C corporation, it will be able to retain the flow through the taxation statute.

In addition, the LLCs will reap benefits from the limited liability status. Besides this, when it comes to a limited liability company, the business will continue to exist as a legal entity of its own. It will provide security to the LLC owner from being responsible for the business debts and operations.

3. Partnerships

When a business is created by more than two people, it is called a partnership. Like sole partnerships, partnerships can reap the benefits of taxation. It indicates that the income will be treated as the owner’s income.

Hence, it gets taxed only once. The partnership owners will be liable for the business liabilities. There are various kinds of partnerships, which include limited partnerships, general partnerships, and limited liability partnerships.

4. General partnerships

It is the easiest to form these types of businesses as it includes the least upkeep costs. Each partner can seek partnership in the business operations. Hence, it comes with limitless liability for the partners. It indicates that the personal assets of each partner will be beneficial in repaying the partnership liabilities. It indicates that every partner will be liable for the actions of the other partner.

5. Limited Liability Partnerships

This type of business partnership is formed when several partners are liable for the business functions or operations. But the partners in the limited liability partnerships will not be liable for the business debts and actions of other partners. Such business is limited to specific professions, like accountants, and lawyers. Though the partnerships provide enhanced flexibility, they are prone to enhanced risks.

6. Limited Partnerships

Such a partnership includes a single general partner. It will require unlimited liability for the partnership only. He is responsible for the management of different business operations. Besides this, limited partnerships include limited partners. They do not establish direct control over the business.

7. Corporation

It is considered a separate legal entity that the shareholders create. Integration of the business will secure the owner from being responsible for the legal disputes and debts of the business. Legally, such businesses continue to exist as separate entities. They will protect you from the situation and continue to exist if the business owner passes away. The different types of businesses are S corporations, C corporations, and non-profit corporations.

C Corporation refers to one of the business types that is taxed as a business entity. The business owner will receive different profits, which will be taxed individually. S corporations are similar to C corporations. As they pass through entities like partnerships, the profits will not be taxed twice. Non-profit corporations are known to be tax-exempt.

Examples of businesses types

eBay is recognized as an example of sole proprietorship business types that is converted into a business. Chrysler, a large automobile manufacturer in the USA, is an example of a limited liability corporation business types. HP, or Hewlett-Packard, is an example of a popular and successful partnership.

What to consider when choosing a types of businesses

Here are the factors you need to take into account while selecting the types of businesses structure:

Complexity

The sole proprietorship is considered a simple business structure. However, it will take extra work to get extra funding. The partnerships need signed agreements for profits and roles. On the other hand, LLCs and business corporations need to report to the federal and state governments.

Liability

The business features the least liability as the customer or creditor will sue the corporation. But, it does not provide access to the personal assets. The LLC offers the prerequisite tax benefits and protection. The partnerships share the desired liability between different partners whereas the sole proprietorships are known to carry different financial liabilities.

Flexibility

If you want to review the business plan and business objectives, you should compare how every structure aligns with the plans. It is important that the structure needs to support change and growth.

Taxes

The LLC owners and sole proprietors will pay the income taxes personally. The partnerships, on the other hand, will claim a share of the business profits as their personal income. The business will file the tax returns and pay the taxes on the profits. However, they will have extra tax exemptions and tax options.

Control

To establish a primary control, LLC partnerships or sole proprietorships into account is primary recommendations. But, it is possible to establish control within the partnership agreement.

Capital investment

The corporations are capable of sourcing the funding, like bank loans, and investors with the securing or funding and selling the stocks. Single proprietorships on the other hand make the right use of credit or seek the assistance of partners.

Why is a businesses types important?

Opting for the proper business legal structure is an integral part of running the business. Whether you want to start the business or grow it, it is important to understand the different options. The legal structure of the business will determine the management, the tax rates, the fundraising abilities, and the paperwork needs, to name a few.

Liability

LLC or limited liability company structures offer security to personal assets during lawsuits. You need to remember that the federal government will not identify with the LLC structures. Thus, they exist at a specific state level only. The C corporations are regarded as the federal business structure, which is inclusive of LLCs’ liability protection.

Fundraising

The structure has the ability to block the raising of funds in different ways. The sole proprietorships are not capable of providing the stocks. It is reserved for business corporations.

Registration

It is important to opt for the business legal structure to register the business in the state. You will not be able to apply for the EIN or employer identification number for the necessary permits and licenses without the prerequisite business structure.

Hierarchy

The business boasts a board of directors. There are specific states in which the board needs to meet a specific number of times every year. The corporate hierarchies should prevent the business closure if the business owner transfers the shares or existing the business company or with the death of the founder.

Paperwork

Every business legal structure boasts unique tax forms. In addition, if the company is structured as a corporation, you should make sure to submit information articles and file specific government reports regularly. If you want to begin a business partnership and perform the business under a specific name, it is important to file specialized paperwork for the same.

Taxes

S corporation owners, partnership owners, and sole proprietors are known to categorize business income as personal income. The C incorporation income is known to be the business income which is different from the personal income of the owner. Taking the tax rates for personal incomes and business, the structure might affect the tax burden.

Potential consequences for selecting a wrong structure

Choosing the proper business structure is essential, although you will be able to change the structure later. Changing the business structure is regarded as a confusing and disorganized process, resulting in tax consequences and unintended business dissolution.

How to choose the right type of business structure

The types of business structure are regarded as the legal representation of the business. It will define the owner of the company and the way in which the business will distribute the different profits. Every business owner comes with a unique business structure before registering with the federal, state, and local governments.

Changing to a unique business structure is expensive and restrictive. Hence, it is necessary to decide on the structure carefully. It is important to consult an attorney, accountant, and business counselor before making the prerequisite decision.

When it comes to selecting the types of businesses ownership, you need to consider what you are protecting, whether you will do the business with other partners if you are planning to get the investors on board, and the way in which you want the businesses to be paid. A wide assortment of people will reach out to a tax professional and lawyer before making the final decision on the kind of entity that will be best for the business.

A crucial decision you can make as a business owner is that you need to restrict your personal liability for business liabilities and business debts. It is useful to businesses in decreasing their exposure. You need to take the number of profits, which are distributed by the business, into account.

Besides this, you should consider the tax profits before forming the business. If the profits pass through, it is an indication that you will add the business profits to your personal tax return. It helps to avoid double taxation, which will happen with the C Corporation.

If you are planning to get the investment plan out or you want to sell the business, the C Corporation is regarded as the best choice as it can be managed easily. The business corporations will include a board of directors. Besides this, they should conduct annual meetings. In addition, it is important for businesses to have more than the necessary filings compared to other kinds of business structures. Finally, it is recommended to select the business type that provides protection while accomplishing growth and tax needs.

Conclusion

It is overwhelming to start a new business owing to the kinds of choices that are available for specific types of businesses. You should take more time to review what is necessary for the tax structure, liability structure, and the kind of flexibility, you want for the ownership.

A crucial step you need to take while creating the business is choosing the types of businesses structure, you need to use. This specific decision will affect crucial business components like personal liability and taxes. Besides this, there are different famous Business Types structures. As a result, it is critical to understand each business type. It is useful in determining the kind of business structure, which is important for the business.